Silicon Valley-based Tribal started private beta testing with MENA startups and is closing a funding round that includes some of the top VCs in the region, a source told Digital Boom.

The fintech, according to its LinkedIn description, promises to help startups in emerging markets overcome local financial barriers, which include difficulty opening bank accounts, issuing corporate credit cards, and restrictions on making cross-border payments.

Fintech Unicorns: Brex, Divvy, Mercury

Similar fintechs which provide services to US-based startups have raised staggering funding amounts. Valued at $2.6B, two-year-old startup Brex raised $382.1M from several investors with Y Combinator, Kleiner Perkins, DST Global, Ribbit Capital, Greenoaks Capital, and Barclays in the lead.

Divvy, Valued at $2.6B, also raised $252.5M over three years from lead investors New Enterprise Associates, Insight Partners, and Pelion Venture Partners among others.

Whereas Series A startup Mercury valued at $100M, secured US $26M in funding this year with Andreessen-Horowitz and CRV as lead investors.

MENA Startups’ Banking Battles

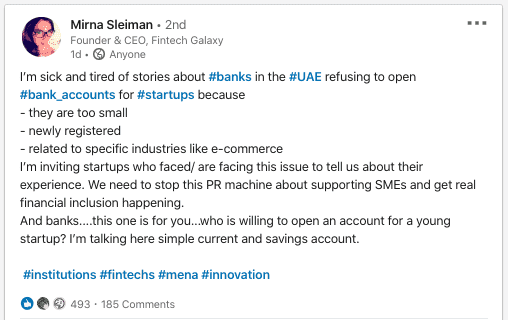

This comes at a time when entrepreneurs in MENA are becoming more vocal about financial barriers. “I’m sick and tired of stories about banks in the UAE refusing to open bank accounts for startups because they are too small, newly registered, related to specific industries like e-commerce,” wrote Mirna Sleiman, Founder & CEO of Fintech Galaxy, in a LinkedIn post.

“We need to stop this PR machine about supporting SMEs and get real financial inclusion happening,” she added asking banks who would be willing to open a simple current and savings account for a young startup.

McKinsey: 200M Financially Excluded SMEs

A 2018 McKinsey report shows that about 200M small businesses in emerging economies lack access to formal savings and credit.

In a recent Forbes piece, CEO of Tribal Credit Amr Shady said emerging markets go through so much pain trying to scale, grow and expand. It takes months to open a bank account for startups in emerging markets compared to a few minutes in advanced markets, he wrote.

“Our aim is to bridge the wide business financial inclusion gap between the two,” says Tribal Credit on its LinkedIn description.

Who’s behind Tribal Credit?

The executive team includes Amr Shady, an Endeavor Egypt board member who founded TA Telecom (Deloitte Technology Fast 500 EMEA) and Aingel, backed by 500 Startups, BECO Capital, and Endure Capital. Ex-HSBC Duane Good is President, and founding member of eCapital Financial, MBNA International, and MBNA Canada Bank.

Bill Crawley is Chief Growth Officer, with ISON Technologies, Bubbe Motion, Net2Phone and IBM on his resume. Chief Strategy Officer, Mohamed Elkasstawi, is a founding partner of the Chicago-based blockchain investment firm, zk Capital. He is a co-investor with Sequoia China, Polychain, USV, Coinbase VC and Pantera. And Chief Compliance Officer, Mark Graves, is ex-Marqeta Inc., SVB Financial Group, and the Financial Industry Regulatory Authority among others.