UAE-based Fintech Startup ‘Qashio’ Raises $2.5M Pre-seed

Qashio, a UAE-based fintech startup for expense management and corporate cards has raised US $2.5M in its Pre-seed funding round to expand to other MENA markets.

The VC firm, MSA Novo, led the Pre-Seed funding. Also supported by Rally Cap Ventures, Palm Drive Capital, Plug, and Play Ventures. Moreover, regional strategic angles, entrepreneurs, and family offices participated in the funding.

The funding will expand the operations team and customer support to evolve the current features and integrations with additional fintech partners and rewards programs.

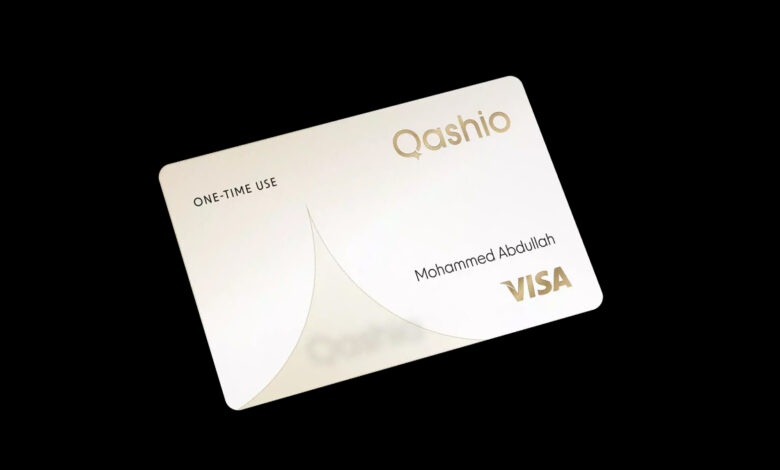

Qashio, founded in 2021 by seasoned serial entrepreneurs Jonathan Lau and Armin Moradi, is a comprehensive spend management platform for businesses to manage expenses, payments with software-enabled corporate cards and all-inclusive accounts payable automation. With Qashio, businesses can build strategic budgets and automate expense reporting.

The startup integrates real-time tracking for every business expense, automates accounting, and provides real-time reporting to better visibility and control overall spending accurately. Qashio allows enterprises and SMEs to make informed cash flow decisions.

“We are committed to having clear, easy, and fast onboarding processes for brands with no long-term commitments or heavy monthly service fees,” stated Qashio CEO Armin Moradi.

With Qashio, business owners, CFOs, HR leaders, and finance teams can set spending limits on virtual & physical cards issued in seconds. Therefore, that eliminates the use of cash, avoids late expense claims, reduces the amount of work put into reimbursements, and ultimately replaces manual invoicing and vendor /supplier payment.

Jonathan Lau and Armin Moradi, co-founders of Qashio, concluded, “Businesses in the MENA region have been operating with limited ability to issue cards and manage employee expenses. At Qashio, we are committed to helping companies move away from all those manual finance processes and get more visibility and control by providing a secure, safe solution that is ready for enterprise-grade deployment as well as SMEs.”