Hell is just a sauna

Here is how I described it in my 1st article in the series:

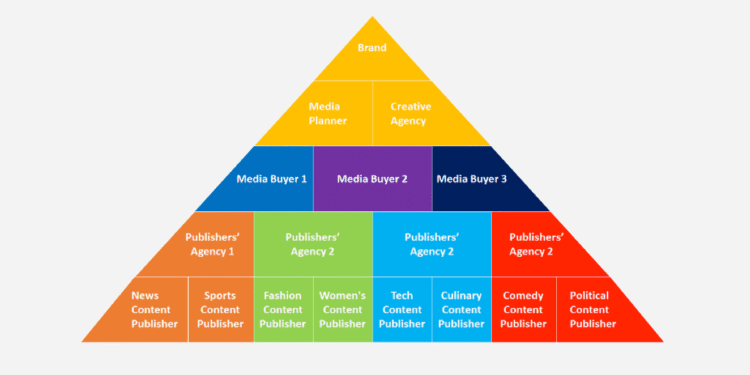

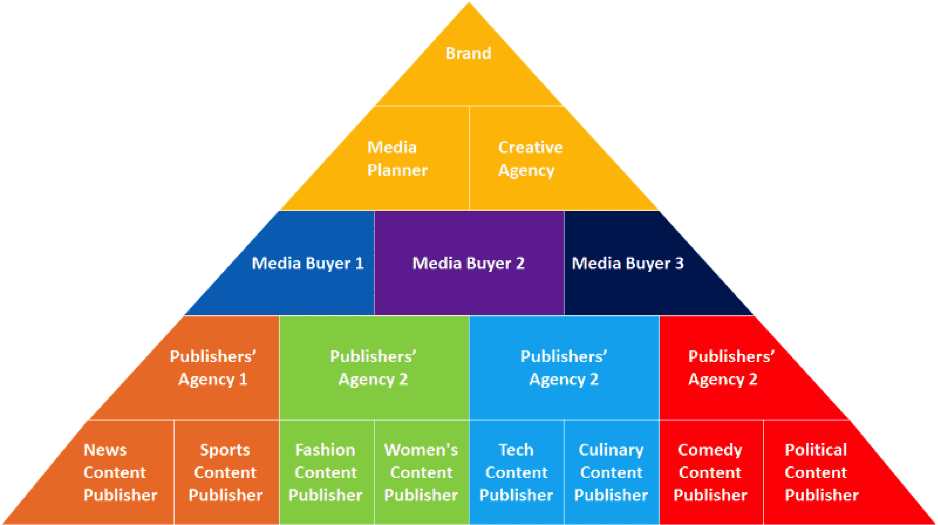

“The value chain in the real [Content Publishing] world consists of: the Publisher — who creates the content, the publishers’ agency — who buys the ad rights to said publisher’s content, the media buyer — who buys ads on behalf of brands because he has ongoing deals with publishers’ agencies and buys from them in bulk, the media planner — who puts together a media plan for the brand, i.e. which ad slots to buy where, in order to achieve their sales targets. This value chain is extremely weak in Egypt and it is very, very hard for new publishers to enter the scene. Smaller digital publishers who made it had to navigate through this messy value chain, and sometimes compensating for its gaps — e.g. selling to brands and media buyers directly.”

What makes the advertising value chain weak and unreliable?

Here are 9 somewhat related reasons in my opinion, not in a particular order:

1. Publishers Agencies are too few, while Content Publishers are relatively many

In a decent world, the Publishers’ agency buys the ad inventory from the Publisher — either in bulk on in tranches coupled with certain traffic targets. This enables the Publisher to focus on Content Creation and user traction. However, the imbalance of this layer in the market enables the agencies to impose better cash flow terms for themselves onto the publishers; e.g. only pay for traffic they get paid by the brands, 90+ days invoice collection periods, etc. While this serves the agencies short term, it keeps content publishers from growing neither their business nor their traffic and user base.

2. A slow economy means budget slashes

Among the first budgets to get slashed are marketing budgets. Cuts happen at the top of the pyramid to the brands’ budgets, and trickle all the way down to the publishers. Therefore, publishers agencies have been facing severe challenges trying to sell their existing inventory. Consequentially, it becomes difficult for them to be interested in representing new Publishers and buying more inventory, which would basically choke their business operation to death.

3. Network sale vs a value sale

In the grand scheme of things, digital advertising isn’t much differentiated. Yes you can segment and target. Yes you can choose publishers based on their audience’s personas. But at the end of the day, it is a comparison between impressions and clicks. And at some point, publishers of the same genre are hard to distinguish by value. So, this transforms the sales process into a network sale, where you rely on your network to sell, rather than the your product’s differentiation. So, you have to be IN with the advertising community to tap into the network and sell regardless how much value your product adds.

4. Advertising efficiency vs Brand exposure

Digital advertising offers budget efficiency and targeting as its core value proposition — you know exactly how many people see your ads and how many take actions based on each campaign your run. However, it is still not officially considered an Above-The-Line channel, which are still the go-to channels for big budget advertisers, as it is still perceived as the main driver of brand exposure. Think TV and high-way billboard ads vs. FB ad campaigns.

5. Tough targets reduce risk appetite

Achieving tough sales target in a slow economy is very hard, which makes advertisers stick with what they know. Therefore, Brands & Media Planners have become too risk averse to allocate budgets for experimenting with new channels, unless an earth shaking disruption had happened and this new channel is a sure thing.

6. Impressions over actions

For some reason foreign to me agencies mostly sell and brands mostly buy impressions (page-views) more than actions (Clicks, acquisitions, purchases, sign-ups, etc.) — generally 90% vs 10%, if not more. In light of the previous point, an explanation would be that impressions are a “guarantee-able” deliverable by the publisher while actions are not. It becomes more plausible when you know that CTR (Click-Through-Rate) are generally low in Egypt. But nothing in Egypt is logically explainable anyway, so whatever.

7. Agency consolidation

Sometimes the three middle layers in the figure above are either fully or partially fused together; e.g. the media planner additionally does the media buying; or the creative agency also does the media planning; or the media buyer cuts an exclusive deal with the publisher, etc. This creates a challenge for anyone who wants to penetrate this fort of an agency to reach its brand, and the sale becomes more challenging — especially for new comers.

8. Every brand has its marketing operations set up differently

With respect to the agencies above: Some brands cover the whole value chain themselves and deal with publishers directly. Others have people who take care of that for them. This is not public knowledge, and you have to gather this information through market intelligence activities — the ethical and the dirty ones.

9. Publishers’ agencies are infamous

For under-performing their sales targets and not paying their dues and invoices in Egypt. This is not a generalization and this is just me repeating a general reputation in the market which may or may not be true. Be that as it may, I’m trying to say: CAUTION!

Google Ads

Theoretically, the easiest path to avoid this ordeal would be to rely on ad networks like Google Ads. Not surprisingly, such networks require massive traffic, i.e. millions of impressions and unique/active users per month. Not just that, it also forces you to run a very small content operation relative to the traffic. This is because the money you get from those networks isn’t really much for a company. On average, Google takes away 70%-90% of what the advertiser pays to display ads on your site, and you get the rest. The tiny, tiny rest.

As a rule of thumb, you need about 1–3 million impressions per month for every member on a team based in Egypt, and even then it doesn’t guarantee decent money.

Otherwise, you need to master your way around the aforementioned value chain — one way or another. Only then will you be able to sell ads locally at better margins.

Conclusion

Most conclusions relating to this article are already mentioned in the previous article about selling advertising. However, here are a few bonus advice:

- Bottom line, to build a tech product (website or app) that relies on ads, you need to have the right connections along the advertising value chain, find yourself a sizable unique niche, build the traffic, sell it. Way easier said than done.

- Know the brands you plan to sell to and figure out one way or another how they are spending their budgets. You will have to have (or build) strong relationships and allies in the market to gather this intelligence.

- Know the people behind the budget allocation decisions and play to what makes them tick.

Next stop: B2C Tech Products.