Advertising

SellAnyCar.com Expands into Saudi Arabia

SellAnyCar.com, the UAE pioneer and leader in online auto marketplaces for used car sales, announced today it is expanding into Saudi Arabia used car buying market with the launch of Kayishha.

Kayishha will integrate the SellAnyCar.com core value proposition and advanced technology engine with an international dealer buying network and auto inspection locations to enable people across the country to sell any make, model or year car in any condition within 30 minutes at fair market value.

The company’s entry into the Saudi market is supported by the recent $35 million investment from Sanabil Investments, a unit of the Saudi Arabia Public Investment Fund, which has recently invested in a number of high-growth technology and e-commerce platforms as part of advancing the national economic diversification strategy.

“We see tremendous opportunity for Kayishha to redefine how used cars are bought and sold in Saudi the same way SellAnyCar.com totally disrupted the UAE used car marketplace,” said Saygin Yalcin, founder and CEO of both SellAnyCar.com and Kayishha. “We’ve taken the pain points out of the process for both the seller and buyer and effectively levelled the playing field so both parties get what they most want and need. Dealers can get a daily list of available cars to keep their lots well stocked. At the same time, the sellers get a simple, stress-free and transparent way to immediately get fair market value for their cars. Everybody wins.”

The SellAnyCar.com auto marketplace was created to address used car seller pain points when selling directly through a classified advertising or to dealers. Through predictive data analytics, the SellAnyCar.com website has a documented ability to assess the fair market value of any car with 92% accuracy.

With Kayishha, the company is investing in both talent and infrastructure to achieve similar growth results in a much larger market opportunity. Kayishha is investing heavily in job creation through an expansion plan that calls for hiring more than 300 people across the country over the next 18-24 months.

At launch, the company will have locations in high-traffic and easy to access shopping malls and retail centres in Riyadh, Jeddah and Dammam with a rapid expansion plan designed to open more than 100 locations within one year. In addition, the company is building its headquarters and customer service centre in Riyadh. While Kayishha will employ both Saudi nationals and expatriates, the company will emphasize the hiring of local citizens, particularly in the customer service centre which will be staffed entirely by Saudi nationals.

“We built a proven model with SellAnyCar.com that we are absolutely confident will bring great value to both used car sellers and buyers across Saudi Arabia. At the same time, with Kayishha we are committed to building a distinctively Saudi company that invests locally, hires locally, respects and embraces Saudi culture, and contributes to the economic and social development pillars of Vision 2030. We even chose the name Kayishha due to its unique meaning and popularity in local slang for paying me cash now,” Saygin Yalcin said.

Advertising

Advertising and Digital Adoption in MENA and SEA

As traditional advertising revenues plummet globally and broadcasting budgets are slashed, The Middle East and North Africa (MENA) and South East Asia (SEA) regions have reported tremendous growth in digital adoption and a rise in digital advertising revenue as a result.

This growth is driven by an increase in internet users, smartphone penetration, and the rise of social media platforms. AI Copywriter tools are now being widely adopted by brands, organisations, and companies in these regions to enhance their digital advertising campaigns.

Let’s delve deeper into the trends and statistics of advertising revenue and digital adoption in MENA and SEA.

Digital Advertising in MENA

MENA has emerged as one of the fastest-growing digital advertising markets, driven by a young population and increasing smartphone penetration. According to a report by McKinsey, the United Arab Emirates (UAE) has the highest degree of digitisation, while Egypt represents the largest untapped opportunity. The report also highlights a growth in the adoption of digital channels and spending in the coming years, coinciding with the increased use of artificial intelligence (AI) across all sectors.

The Market Size

The digital advertising market in the MENA region is estimated to be worth over 1.2 billion U.S dollars in 2021. The market is expected to continue growing, with a projected growth rate of 20% by 2024. The region’s e-commerce market is also expected to grow and reach 69 billion U.S dollars by 2020. The GCC and Egypt account for 80% of the regional e-commerce market.

Media Channels in the MENA

The advertising market in the MENA region is witnessing a major shift toward digital advertising. Traditional channels such as newspapers are declining, while the internet is taking over with 44.2% of the total ad expenditure in 2020, according to Statista. Social channels account for more than half of the total digital ad spend, surpassing global benchmarks. The region is also moving towards a “mobile-first” strategy, with a majority of internet traffic generated through mobile devices such as smartphones and tablets.

Performance Marketing in the MENA

Performance-based campaigns are gaining traction in the MENA region, with 59% of advertising agencies significantly shifting into performance-based campaigns, according to a survey conducted by the Interactive Agency Bureau (IAB). Brands are demanding payment by results (ROI & Return on ad spend ROAS) as well as enhanced consumer insights and analytics.

Digital Advertising Agencies in the MENA

The MENA region has over 500 advertising agencies that have a large number of employees, with Egypt, Saudi Arabia, and the UAE fuelling the region with small and medium-sized agencies. The UAE is home to big advertising firms, while Egypt, Lebanon, and Jordan represent the majority of digital marketing talents and creative resources. However, the highly qualified talents in digital advertising and performance are always moving outside the region to join companies in the European market.

Programmatic Advertising in the MENA

The slow transition from traditional to digital media is one of the key reasons programmatic advertising is struggling to dominate the region. Collectively, the MENA trails other regions in innovation and adoption of ad tech and marketing technologies. The top ad networks in the MENA region include Facebook, Google Ads, IronSource, Applovin, Adcolony, AdFalcon, InTarget, AdZouk, and Ambush. The United Arab Emirates is leading the growth in programmatic advertising due to technology partners and pressure from clients and brands to automate the process and use AI.

Digital Advertising by Sector

According to Ipsos research, the top ten sectors in the region are dominated by beauty care, food, telecommunications, and entertainment. Telecommunications companies, followed by real estate and banking, are the top categories.

Digital Advertising in SEA

SEA is a rapidly growing digital advertising market, driven by a young and tech-savvy population. According to a report by eMarketer, digital ad spending in SEA is expected to reach 15.3 billion U.S dollars in 2021, with Indonesia, Thailand, and Vietnam leading the growth.

The Market Size

The digital advertising market in SEA is expected to grow at a rate of 13.7% in 2021, with a projected market size of 22.45 billion U.S dollars by 2025. The region’s e-commerce market is also booming, with a projected market size of 153 billion U.S dollars by 2025.

Media Channels in SEA

SEA is also witnessing a major shift toward digital advertising, with traditional channels such as newspapers and TV declining. Social channels are the most popular, accounting for 63% of total digital ad spend, according to a report by Hootsuite. Mobile advertising is also on the rise, with a majority of internet traffic generated through mobile devices such as smartphones and tablets.

Performance Marketing in SEA

Performance-based campaigns are becoming popular in SEA, with advertisers demanding more accountability and transparency. Brands are looking for more measurement and optimisation to ensure their campaigns are reaching the right audience and delivering the desired results.

Digital Advertising Agencies in SEA

SEA has a large number of digital advertising agencies, with many emerging startups and creative agencies. The region is home to a highly skilled workforce, with many professionals trained in digital marketing and advertising.

Programmatic Advertising in SEA

Programmatic advertising is becoming more popular in SEA, with many brands and agencies adopting the technology to automate their advertising campaigns. The region is also seeing an increase in the use of AI-powered tools and platforms to help advertisers optimise their campaigns.

Digital Advertising by Sector

The digital advertising market in SEA is dominated by the retail and e-commerce sector, followed by the travel and hospitality sector. The region is also seeing growth in the financial services, healthcare, and automotive sectors.

AI Copywriter Tools in Advertising

AI copywriter tools are becoming increasingly popular in the MENA and SEA regions, with many brands and agencies adopting the technology to enhance their digital advertising campaigns. These tools use natural language processing (NLP) and machine learning algorithms to generate high-quality, engaging content that resonates with the target audience.

AI copywriter tools can help brands and agencies save time and money by automating the content creation process. They can generate a large volume of content quickly and efficiently, allowing advertisers to test multiple variations of their ads and optimise their campaigns for better performance. AI copywriter tools can also help advertisers improve the quality of their content by ensuring that it is grammatically correct, engaging, and relevant to the target audience. They can analyse data from social media and other sources to identify trends and insights that can inform the content creation process.

Conclusion

The MENA and SEA regions are witnessing tremendous growth in digital advertising and digital adoption, driven by a young and tech-savvy population, increasing smartphone penetration, and the rise of social media platforms. AI copywriter tools are becoming increasingly popular in these regions, providing brands and agencies with a cost-effective and efficient way to enhance their digital advertising campaigns. The future of digital advertising in these regions looks bright, with continued growth and innovation in the years to come whilst broadcast and traditional advertising feels the pinch. The time has come for the more conservative amongst us to take the plunge and fully embrace digital and all it entails.

Advertising

Facebook Sunsets Special Ad Audiences in October

Facebook will no longer allow Special Ad Category advertisers to use the Special Ad Audiences tool.

Meta will be sunsetting Special Ad Audiences, a tool that lets advertisers expand their audiences for ad campaigns related to housing, employment, and credit ads.

In 2019, in addition to eliminating specific targeting options for housing, employment, and credit ads, Facebook introduced Special Ad Audiences as an alternative to Lookalike Audiences.

Since the Cambridge Analytica scandal, Special Ad Category advertisers must declare their category before creating ads. If advertisers fail to declare it, the Facebook policy team shuts down their advertising accounts.

Now, it’s getting more limited with this new rule.

Deprecation Timeline

Following is the timeline from Meta regarding the deprecation of Special Ad Audiences:

- August 25, 2022: you will no longer be able to create new Special Ad Audiences.

- September 13, 2022: Special Ad Audiences will no longer be available in new ad creation via the API.

- October 12, 2022: Special ad audiences will no longer be available in new ad creation across Ads Manager and the API. After this date, the affected ad sets may be paused for delivery. To resume delivery of the paused ad sets, you will need to update them to remove Special Ad Audiences.

According to this timeline, you’ll no longer be able to use Special Ad Audiences in new ads via the API on September 13 and Ads Manager on October 12.

How can the Special Ad Category advertisers benefit from Facebook after this update?

It’s still unclear if Facebook is going to introduce a new way or release some restrictions for Special Ad Category advertisers or not.

That said, the only option is to go broad audience. However, some other options still benefit from the Facebook advertising platform. I will prepare some tips and tactics. Please keep an eye on Digital Boom for more.

Advertising

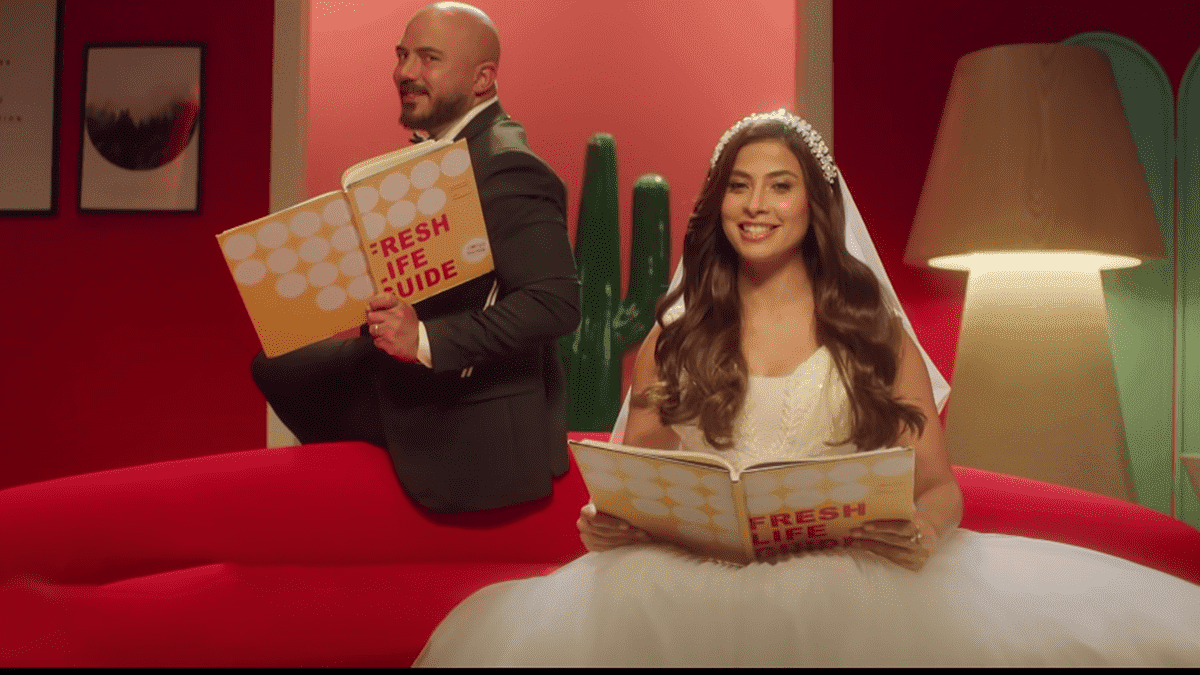

Fresh Ramadan 2022 Ad Features Ruby, Mahmoud El-esseily

Fresh Egypt, a Home Appliance company kicked off its Ramadan campaign with a 1:43-minute Ad promoting the company’s products. Starred by Ruby and Mahmoud El-esseily.

The Ad gained more than 600L views on YouTube and over than 1.2M views on Facebook. Fresh Egypt Ad caught the audience’s attention with its beautiful rhythmic song, saying, “because everything is much better when it’s fresh, make your life fresh and day delightful.”

Some people described it as one of the most beautiful ads this Ramadan, especially Ruby and Mahmoud El-esseily fans. Although it’s a bit different than last year’s ad that was performed by Ruby and Dina El-Sherbiny went viral in a split second.

Watch last Ramadan’s Fresh Ad featuring Ruby and Dina El-Sherbiny.

-

Startups9 years ago

Startups9 years ago3 Creative Egyptian Women Who Master E-commerce

-

News10 years ago

News10 years ago11 Talented Egyptian Photographers on Instagram

-

Campaigns8 years ago

Campaigns8 years agoVodafone Egypt Brings Generations Together, Unlocks 4G Power

-

Marketing9 years ago

Marketing9 years agoWhich categories will suffer most from increased prices in Egypt?

-

Apps8 years ago

Apps8 years agoRadio Garden Live Map of The Globe’s Radio Stations

-

News8 years ago

News8 years agoTop 10 Egyptian Fashionistas to Follow on Instagram

-

Campaigns8 years ago

Campaigns8 years ago7 Big Stats That Show Which Ramadan Advertisements Resonated Most

-

Opinion9 years ago

Opinion9 years agoF*** Being a Founder, Be a Follower