Advertising

Stay informed on the latest advertising trends, strategies, and insights. Discover groundbreaking campaigns and industry updates for exceptional results.

-

Advertising and Digital Adoption in MENA and SEA

As traditional advertising revenues plummet globally and broadcasting budgets are slashed, The Middle East and North Africa (MENA) and South…

Read More » -

Facebook Sunsets Special Ad Audiences in October

Facebook will no longer allow Special Ad Category advertisers to use the Special Ad Audiences tool. Meta will be sunsetting…

Read More » -

Fresh Ramadan 2022 Ad Features Ruby, Mahmoud El-esseily

Fresh Egypt, a Home Appliance company kicked off its Ramadan campaign with a 1:43-minute Ad promoting the company’s products. Starred…

Read More » -

Zed Ramadan Ad 2022 Brings More Celebrities, Promotes Happiness

Zed has released its Ramadan 2022 brand campaign showing how happiness is everywhere at its new properties, the ad has…

Read More » -

Etisalat Egypt Ramadan 2022 Ad Features Ahmed Ezz, Carmen Bsaibes

Etisalat Egypt kicked off Ramadan 2022 media race with a brand TVC that promotes Etisalat’s position in the market. The…

Read More » -

Vodafone Egypt’s Ramadan 2022 Ad Sparks Feelings

Vodafone Egypt kicked off the Ramadan media race with a brand TVC “Eli Benna Hayah” which translates to “What We…

Read More » -

Egypt Bans Dice Ad in Ramadan 2022 Over Alleged Ethical Violations

Dice Underwear’s ad for Ramadan 2022 has been suspended over alleged ethical violations by the Supreme Council For Media Regulation.…

Read More » -

Egyptian Food Bank’s Ramadan 2022 Ad Invites Egyptians to Share Happiness

Urging people to donate to feed fasting needy people this year, the Egyptian Food Bank put up a great ad…

Read More » -

Telecom Egypt Steals The Ad-Show in Ramadan 2022

Telecom Egypt launched its Ramadan 2022 commercial TVC on social media and Youtube, starred by Yasmine Abdel Aziz and Karim…

Read More » -

Orange Egypt Debuts Ramadan 2022 With A Real Delight

Orange Egypt kicked off the Ramadan media race with the late star Soad Hussny’s “Egypt sweetheart” movies themes, starred by…

Read More » -

Throwback: Most Watched Brand Ads in Ramadan 2021

An entertaining, heartwarming ad is a forgiving excuse to interrupt a good series, especially during Ramadan when people seek comfort…

Read More » -

Ukraine war: Cannes Lions suspends award entries from Russia

Cannes Lions has banned award submissions and delegations from Russian organizations for this year’s Festival of Creativity, in response to…

Read More » -

WPP Withdraws Operations in Russia to condemn Ukraine Invasion

WPP is shutting down its operations in Russia due to the country’s invasion of Ukraine, a move that will affect…

Read More » -

AWstreams ‘You Own it’ A Creative Take on Fashion Advertising

Awstreams, one of the top digital marketing agencies in the Middle East and North Africa, has offered a new take…

Read More » -

How to write ‘Performance Marketing Manager’ job description?

Performance marketing is one of the most trending functions in any startup or growing business; it plays a significant role…

Read More » -

71% of parents in Saudi Arabia are on Snapchat

Snapchat is not only the platform of choice of Millennial and Gen Z audiences in Saudi Arabia but also incredibly…

Read More » -

Facebook accredits Tribe X as Preferred Partner Agency

Tribe X, a pioneering digital marketing agency based in the United Arab Emirates with offices in Netherlands and Egypt, has…

Read More » -

Google Ads: Target Audience Explained

Google Ads is one of the most popular advertising platforms worldwide. Through Google Ads, you can reach your target persona…

Read More » -

Facebook teams up with TBWA\RAAD to showcase people behind #LoveLocal

Facebook has teamed up with leading regional creative agency, TBWA\RAAD, for its new campaign, #LoveLocal, an initiative to support local…

Read More » -

SellAnyCar.com Expands into Saudi Arabia

SellAnyCar.com, the UAE pioneer and leader in online auto marketplaces for used car sales, announced today it is expanding into…

Read More » -

A Short History of Influencer Marketing

Promoting or recommending a product is commonly seen all over the internet, particularly on social media or bloggers pages. Influencer…

Read More » -

Facebook Reveals Top Emojis in MENA, Celebrates World Emoji Day

History has shown us that images are worth more than words. Thanks to the rise of visual-based communication, we are…

Read More » -

60% of Arab users prefer using emojis over words to express emotions

Viber, owned by the Japanese company, Rakuten, and one of the world’s leading apps for free and easy communication, conducted…

Read More » -

Facebook introduces new distribution metric

Yesterday, Facebook released a new metric called “distribution score” to measure the performance of Facebook pages. The company defined the…

Read More » -

OSN Network Drives Up To Six Times Online Sales Using Facebook Ads

The Middle Eastern TV operator, OSN, saw online sales rise 6.3 times after using the Facebook website conversions ad objective.…

Read More » -

Mohamed Salah Returns To Social Media With DHL Ad

Liverpool’s forward, Mohamed Salah has returned to social media today, followed by a photo post of himself opening a DHL package. Salah…

Read More » -

Facebook Ads Manager is back up after reported outage prior Black Friday

If you had trouble publishing ads on Facebook and Instagram in the last 48 hours, you weren’t alone. Facebook Ads Manager…

Read More » -

Facebook Ads Manager goes down prior Black Friday

Facebook Ads Manager tool went down for several hours on Tuesday, leaving brands and advertisers unable to run Black Friday…

Read More » -

Spotify announces advertising partners for launch in the Middle East, North Africa

Top brands Hardee’s, Lipton, Mercedes-Benz Cars Middle East, Mountain View, Samsung Gulf Electronics, The Coca-Cola Company, and Western Union partner…

Read More » -

Spotify is now available in the Middle East and North Africa

The music-streaming service Spotify went live in 13 countries across the Middle East and North Africa today, including Egypt, Saudi…

Read More » -

Snapchat Unveils Next Generation of E-commerce Ad Products

Snapchat is launching the next phase of e-commerce advertising on the platform, following the launch of an advanced performance marketing…

Read More » -

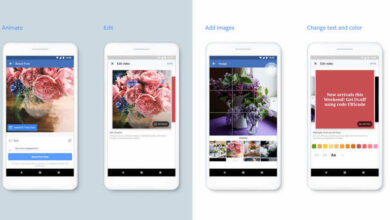

Facebook Launches Video Creation Tools to Help Advertisers Build Mobile-First Video Ads

Facebook has introduced new video creation tools that enable advertisers to easily convert existing images and text assets into mobile-first…

Read More » -

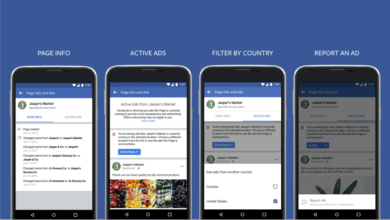

Facebook allows users to see all active ads run by a page for more transparency

Facebook is making significant steps to bring more transparency to ads and Pages, in light of Cambridge Analytica scandal this…

Read More » -

Dubai Lynx Announces 2018 Awards Winners

The annual Dubai Lynx International Festival of Creativity concluded this evening with an Awards Ceremony following three days of talks,…

Read More » -

Facebook forbids cryptocurrency, ICO ads

Facebook banned ads for cryptocurrency and related activities in a new advertising policy issued on Jan. 30, which claims the…

Read More » -

Wonderlists solves the Unwanted Gifts dilemma in Lebanon

A new online platform from Wonderlists solves the unwanted gifts dilemma, making couples and gifters in Lebanon very happy. The service…

Read More » -

NGOs Ad Value Exceeds EGP 250 Million in Ramadan 2017

The number of commercial spots presented by non-profit organizations during Ramadan is valued at EGP 250 million in Egypt, according to…

Read More » -

Cannes Lions 2017 Predictions: Less roaring, more bite

“Doing good” is for most brands (and agencies) like pissing in a wet suit. It feels nice and warm, but…

Read More » -

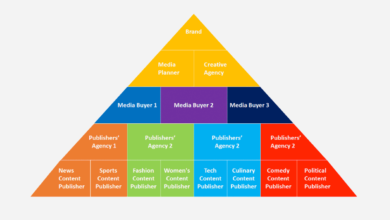

The Entrepreneurship Opportunity in Egypt (5): The Advertising Value Chain

Hell is just a sauna Here is how I described it in my 1st article in the series: “The value chain…

Read More » -

Pizza Hut under fire for mocking Palestinian hunger strike

Pizza Hut faces a social media backlash and a boycott campaign after its Israeli branch posted an advert mocking the…

Read More » -

Anghami grows its Audio Ad business in the region three-fold in one year

Dubai – Anghami, the leading music streaming company in the MENA region, revealed today that it has recorded an amazing…

Read More » -

Google boycott: Is it all about free PR?

Originally Published by Stefan Michel – professor of marketing and service management at IMD business school in Switzerland. Swiss companies, such as the…

Read More » -

Report: Facebook comes to life in Ramadan

Facebook has released a new report on how people share their Ramadan experiences, find inspiration, and discuss their passions on…

Read More » -

Emirates Airline pledges to entertain passengers despite US electronics ban

Emirates Airline released a refurbished version of their Jennifer Aniston’s TV advert showing off their 2500 channels of entertainment while…

Read More » -

Independent Enthusiasts for Gun Control: Every 27th

Visitors of webrifle.org can control a robotized rifle with a touchpad and “shoot” real people with a tap on a space button in real-time online.…

Read More » -

Instagram reaches 63 million users in the MENA region

Cairo Feb 21 – Facebook-owned photo-sharing app Instagram has revealed for the very first time that the Instagram community in the MENA…

Read More » -

Careem Egypt Brings Vertical Video Ads To The Middle East

Careem Egypt produced the first-ever vertical video ad in the Middle East, introducing its new car types Go and Go+.…

Read More » -

Creative Project: ‘Brand Yourself’ by GearBox Studios

GearBox Studios launched a new personal project to help job seekers show what’s important to recruiters. They used the philosophy…

Read More » -

FC Barcelona drops Qatar Airways logo from jerseys next season

Starting next season, Japanese retailer Rakuten will replace Qatar Airways as the main global partner of the Spanish football team FC Barcelona,…

Read More » -

Real Madrid Launches Arabic Ad Campaign on Facebook

Update: Real Madrid Appoints Kijamii as Digital Agency in MENA We’ve noticed today a circulated ad in Egypt by Real Madrid official…

Read More » -

Google, Facebook ban fake news websites from advertising revenues, but is it enough?

Google said it’s working on changes to stop websites making money via Adsense. Facebook announced it would not serve ads in…

Read More » -

5 Hacks Can Improve Your Twitter Advertising Strategy

Twitter is the most dynamic, live and conversational social media platform, we’ve prepared 5 more ways to get your even…

Read More » -

10 Most Watched Ads on YouTube in MENA – July 2016

July’s monthly round up of most popular ads on YouTube showcases a continuation of a love for moving Ramadan ads,…

Read More » -

The Entrepreneurship Opportunity in Egypt – 4: B2C Tech products: Selling Advertising

It is really easy to decide to base your product’s business model on Advertising. However, making it happen is anything…

Read More » -

10 Most Watched Ads on YouTube in MENA – June

June or maybe we should call it Ramadan this year. Many brands celebrated the holy month and all, mainly telecom…

Read More » -

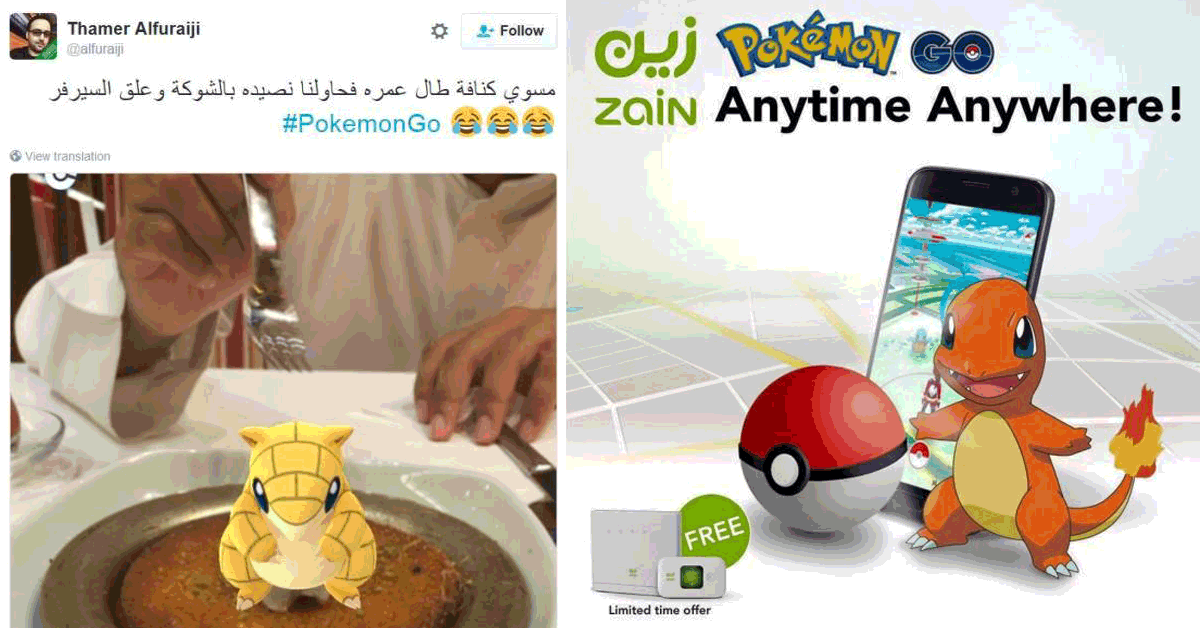

Pokemon Go Craze in The Middle East

I wanted to write on something fairly light and fun today in light of recent the Middle East and Europe…

Read More » -

Facebook now accepts payments in Egyptian pound

Egyptian digital advertisers can now choose to pay for facebook ads in the local currency (EGP). The social network has added the Egyptian…

Read More » -

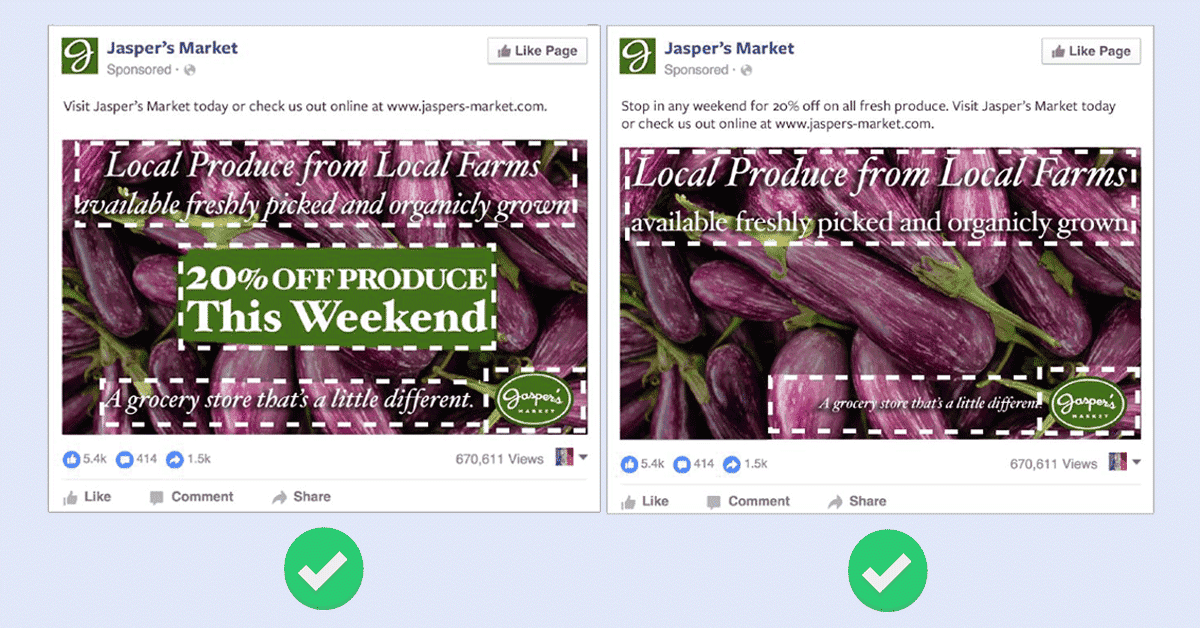

Facebook lifts 20% text overlay image restrictions for all

Your ads are Facebook-approved regardless of the amount of text used, as facebook has dropped it’s 20% text overlay rule for all marketeers…

Read More » -

10 Most Watched Ads in MENA April 2016 on YouTube

Football fever took a big part of April’s advertisements, due to the peak of international championships: UEFA champions league and…

Read More » -

Eatimate Cost of Ramadan 2016 TV Ads in Egypt

Egyptian television channels raised their ad spot prices for Ramadan 2016 by 50 percent to bring their advertising revenue up to EGP…

Read More » -

The 10 Most Watched Ads Globally on YouTube in April 2016

Google has released the top ten most-watched advertisements on youtube in April 2016. Here’s a round-up of April’s most-watched ads worldwide according…

Read More » -

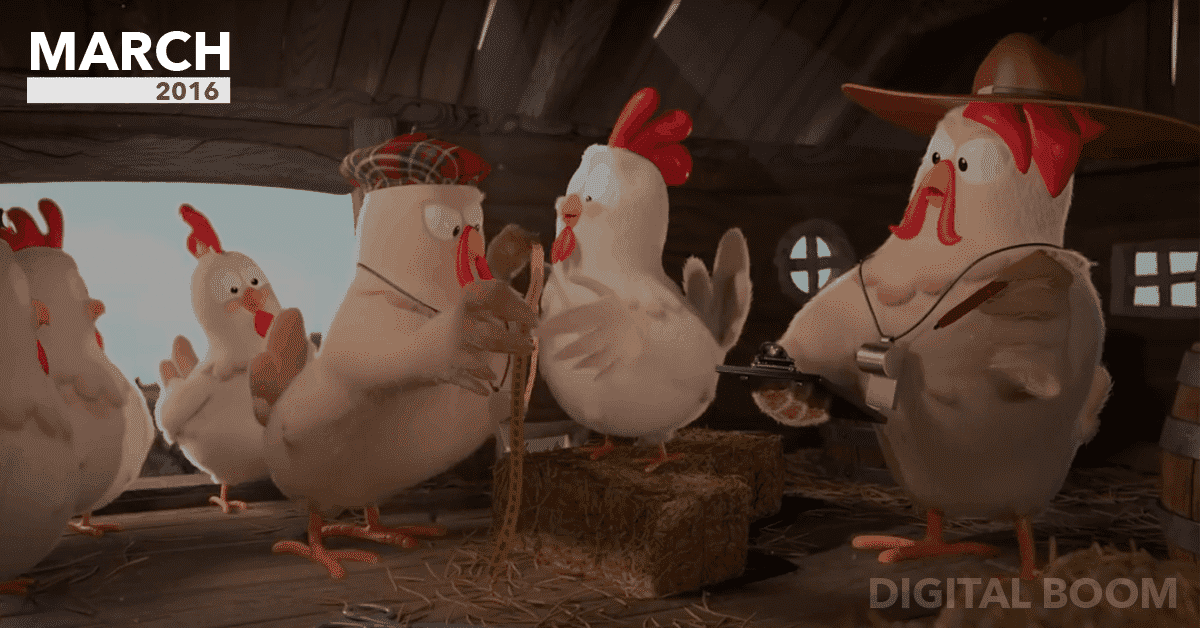

10 Most Watched Ads on YouTube in MENA March 2016

Youtube has released the top 10 watched advertisements in the Middle East and North Africa region for March 2016. Here’s a round-up…

Read More » -

6 Interesting Insights from the Egyptian Publishing Industry – March 2016

Numbers never lie, So we talk numbers. The digital media industry pays great attention to “Data” every day, one of the…

Read More » -

The 10 Most Watched Ads on YouTube March 2016

YouTube March 2016 top ten most watched advertisements leaderboard has been revealed and here’s the list: 1- Always #LikeAGirl – Girl Emojis 72%…

Read More » -

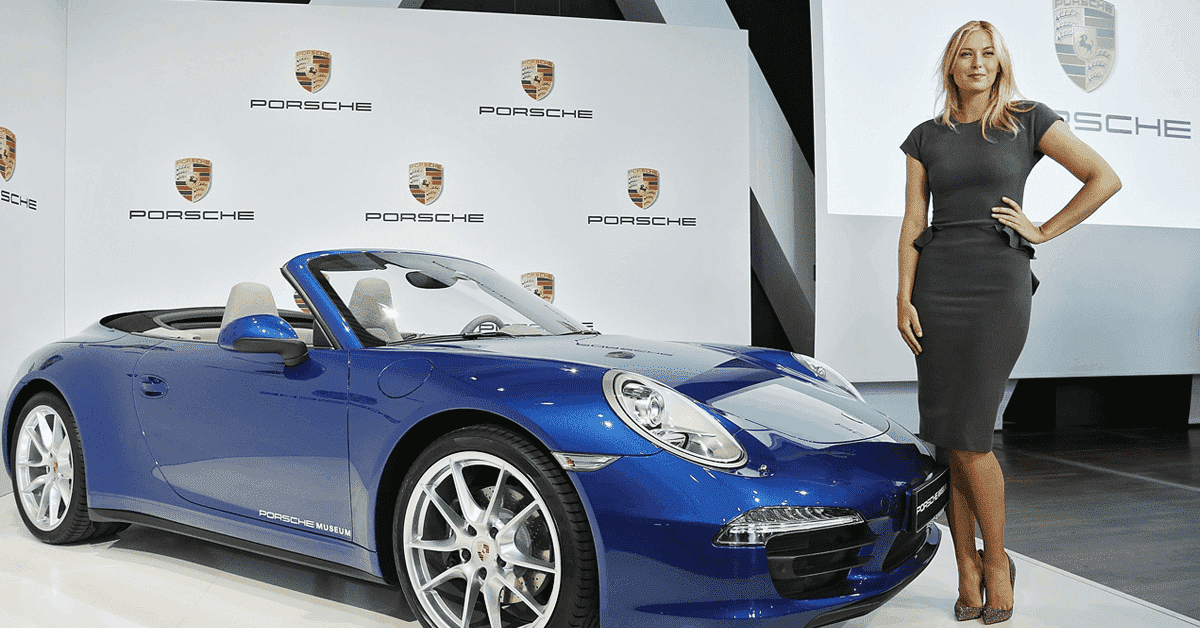

Brands Stop Sponsoring Maria Sharapova over Failed Drug Test Results

Nike and TAG Heuer dropped sponsorship of Maria Sharapova, and Porsche suspended all activities with the famous tennis player until…

Read More » -

Voting now open for 2016 Oscars best commercials in MENA

It’s time to take action, it’s time to VOTE! Our 2016 Oscars Best Commercials in collaboration with the leading Arabic digital…

Read More » -

A Message To Humanity: Treat Refugees Like Animals

The Association for the Rights of Immigrants and Refugees in Tunisia “ADIRT” in collaboration with the media agency Memac Ogilvy Label launched a…

Read More » -

Turkish Airlines Supports Fenerbahce From The Sky

Turkish Airlines decided to carry the love of soccer fans from ground to the sky, to support Fenerbahce team on their…

Read More » -

Innovative Violence Against Women billboards in Cairo

FP7/CAI and UN Women teamed up to create some remarkable violence against women billboards campaign on 6th of October Bridge…

Read More » -

African Cristal Festival: Sphinx Awards Winners 2015

The Sphinx Awards ceremony revealed the Egyptian winners of the African Cristal Festival in Cairo last week. The Jury, constituted…

Read More » -

FP7/CAI named agency of the year 2015 at MENA Cristal

FP7/CAI was named “agency of the year 2015” at the MENA Cristal in Cairo last week, with Gold and Emerald for Baheya’s Pink…

Read More » -

Coca-cola Boosts Happiness With a Bridge For Santa

The TV Commercial Ad titled “A bridge for Santa” was done by J. Walter Thompson advertising agency for Coca-cola in Brazil.…

Read More » -

How to create your first Instagram advert?

You must have heard the news about Instagram ads launch, but how to create your first Instagram advert? Facebook is still rolling…

Read More » -

Crowd in Front of Dunkin Donuts Because of a Facebook Promo

Cairo – Dunkin Donuts Egypt announced a generous promotion of one year free donuts offered to the first 250 customers who arrive…

Read More » -

Coca Cola becomes the first brand to get its emoji on twitter

Coca Cola became the first brand to get a branded emoji on twitter. The Coca-Cola emoji featuring two Coke bottles clinking…

Read More » -

Instagram is Rolling out Ads in Egypt, MENA

Today, Egypt has woke up to exciting news on the social media scene. Instagram Ads are coming very soon. A…

Read More » -

Huawei Joins Ramadan Advertising Race

The beauty of Ramadan advertising is that you don’t always need to get overly creative to come up with an…

Read More » -

Vodafone Kicks off Ramadan 2015 Media Race

Vodafone Egypt kicked-off Ramadan’s media race with a brand TVC. The ad theme “قوتك في عيلتك” is portraying how people…

Read More » -

Amr Diab Starring Western Union New TVC

The international money transfer giant “Western Union” kicked off a new TV Commercial featuring the Egyptian legend Amr Diab’s success story to build…

Read More » -

Vodafone Egypt Features the Amr Diab Effect

Vodafone Egypt has launched a new advert featuring the Amr Diab’s effect on youth culture over the past three decades. Portraying…

Read More » -

Dolce 2015, Thank You Jumana

Dolce kicked-off summer 2015 activations with a TVC hitting on the corporate life drama. The new product which called Dolce…

Read More » -

Chipsy Egypt Draws 90 Million Happiness

Chipsy Egypt kicked off a new positive advertising campaign calling for the start of a “90 million laugh”. Featuring Egyptian…

Read More » -

Coca Cola Egypt Celebrates 100 Years With Sham El-Naseem

Coca-Cola is celebrating 100 years with the world this year. Each country/region is creating a localized campaign inline with the…

Read More » -

Easy way to add ‘call to action’ button to Facebook posts

We recently posted about new changes taking place in the Facebook arena, about the enhancements Facebook is going to roll-out…

Read More »