Cassbana, a financial identities’ startup, announced raising a pre-seed round of 6 digits USD to revolutionize the financial service industry in emerging markets.

Disrubtech, a US$25million Fintech fund, led the investment round among other investors. Disrubtech was established by Mohamed Okasha, Fawry’s co-founder and former managing director.

Since it was launched in June 2020, Cassbana has managed to gain significant grounds in the Egyptian market with its instant financial identity Android app. The app is designed to enable suppliers and merchants to sell their products to their customers through short-term loans allowing them to serve Egypt’s largely financially underserved market.

Speaking to Haitham Nassar, Cassbana’s Founder CEO and former Careem Planning Director in Egypt, he pointed out what makes Cassbana essentially different from any “Fintech” initiative or startup.

He says, “The entire point behind Cassbana is to create financial identities for the underserved in Egypt where shadow economy is almost double or triple the size of the formal economy, Cassbana is used to assist suppliers and merchants in making better, less biased decisions and helping them take more impactful and real-time decisions using our technologies.”

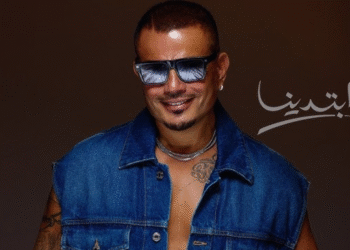

Haitham Nassar- Cassbana Founder& CEO

“These financial identities will help the suppliers and merchants to take a proper decision on how they can serve their customers, especially those unbanked, and allow them to find funding through alternative means.”

Putting the Tech in Fintech

The platform relies on Machine Learning and Artificial Intelligence to gather certain behavioral data points that, in turn, develop patterns. These patterns will help financial institutions detect fraud better while allowing the non-fraudulent borrowers to be seen and supported, and more importantly, banked beyond the expected stack of documents.

The market entry for Cassbana relies heavily on the supply chain market as it is an easy entry for small sellers defaulting to suppliers constantly, and suppliers are eager to have a tool in place to allow them to make proper decisions when they borrow their customers. Instead of defaulting on their wholesale merchandise, they purchase the products needed in installments to keep the business going.

“If a seller needs merchandise worth 5000 EGP but can’t afford it, chances are they will either close up shop or search for a supplier who can give it to him on installments. Cassbana uses the power of community to support micro-businesses with an instant decision-making tool. It allows the suppliers to immediately decide whether to sell such products on installments to the merchant or not, which helps keep them afloat while using the data points to grow our data banks,” Haitham says.

“So in a short time, any supplier, merchant, or financial institution looking into micro-lending will have a data bank of financial identities to offer low-risk loans to those who truly deserve it.” He adds.

With a team of data analysts and machine learning experts, Cassbana also focuses on the tech part of Fintech, with plans to use the funding to grow its tech team further and develop the algorithms.

The Cassbana Equation for Financial Inclusion

Serving Financial Inclusion

Haitham notes Egypt’s bid for Financial Inclusion.

“While Egypt’s financial and regulatory entities strive wonderfully to bank the unbanked, Cassbana has come out to offer an alternative, reliable, fraud-free way of offering solutions that enable suppliers and merchants to finance their customers.”

“Maybe it is time we started seeing shadow businesses differently, and it is our duty to help them become registered, taxed, and growing in a healthy financial ecosystem. besides, it helps shadow economy players to take proper financial decisions based on our technologies.”