News

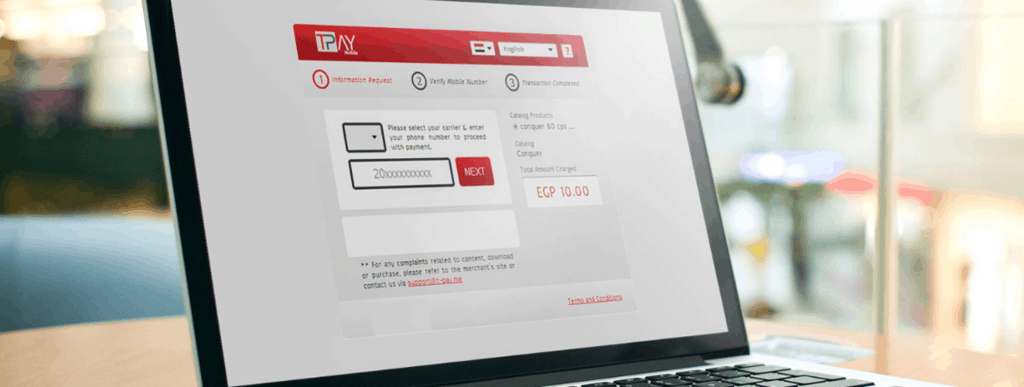

Monetize Your Digital Product Through T-Pay

T-Pay is a new online payment method, introduced to the MENA

region. T-Pay enables users to pay for their online memberships, apps, in app-purchases, online gaming, and even more digital services.

Interview with Sahar Salama, General Manager of T-Pay

We’ve reached out to Sahar Salama, General Manager of T-Pay to give us more details on how T-Pay works, advantages and more. Here you go our interview with her:

Briefly, can you describe for us what T-Pay is all about?

T-PayTM is the first open mobile payment platform in the Arab region. It is a unique local payment eco-system that connects consumers, businesses and mobile operators for Direct Operator Billing (DOB). The platform gives the opportunity for businesses to grow exponentially by reaching new consumers and new markets in the region through one simple integration. It also allows connected consumers to buy goods and services online easily and safely and pay through their mobile line and without the need for a bank account or a credit card. T-Pay also gives mobile operators the opportunity to expand their product offerings and monetize their services and solutions.

How does T-Pay work?

Consumers can now buy digital goods and services or subscribe

to them, through a click of a button. Purchases are processed on

the T-Pay platform real time and added to their monthly bill or their pre-paid account. Once a T-Pay account is created, the process becomes as easy as 1-2-3.

- First, the user shops for online goods and services then chooses T-Pay as their preferred payment method and enters their mobile phone number.

- Second step, the user receives a Personal Identification Number (PIN) code via SMS and enters it to authorize the payment.

- Third and final step is when the payment process is completed and the user gets instantly its purchased service or good without leaving the merchant page.

The purchase amount is then added to the user’s phone bill or deducted from his balance in case of prepaid lines.

What reach can T-Pay give online businesses and apps?

T-PayTM today enjoys the biggest footprint in direct operator billing (DOB) in the region. The payment platform has partnered

with 21 mobile operators from 10 countries around the region to provide direct operator billing (DOB) to over 200 million mobile subscribers, or more than half of the total population of the Arab region. Digital merchants can now reach these 200 million mobile subscribers with their goods and services, by just connecting to the T-PayTM payment platform. T-PayTM enjoys 100% coverage in the UAE, Saudi Arabia, Egypt, Qatar, Jordan and Palestine. It also offers its services to consumers in Bahrain, Kuwait, Tunis and Algeria. T-PayTM allows customers to charge their purchases directly to their mobile accounts and benefit from its wide network of merchants.

What makes T-Pay a catalyst of monetization for mobile developers?

T-PayTM helps businesses offering digital goods and services overcome the setbacks in their growth, mostly due to issues of payment methods or the lack of them. At the moment, consumers who buy digital goods online pay either through credit cards, pre-paid cards or cash on delivery. The penetration of credit cards in the region is as low as 1.5% to 8%, and even lower with the younger teenage population that has smart mobile devices and consumes digital media. Cash on delivery is the king of all payments in the region, albeit with high risk and high cost to merchants and no fit at all with online services.

Studies show that mobile payments have 5 to 10 times better conversion rate than credit card payments. Hence, digital merchants can increase their sales by up to ten-fold with the introduction of T-PayTM mobile payments to their business model. For low value digital purchases, online businesses will be able to convert 70% of online shopping into real purchases whether from web or in app.

For mobile apps transactions, T-PayTM has simplified the process. Consumers are not required to enter their Personal Identification Number (PIN) for every transaction. They can now use a one-time registration process for quicker and more efficient future transactions. Once they register, they start paying for their purchased digital goods or services by merely entering their mobile number. The transaction will then be added to their monthly mobile telephone bill if they have a post-paid number, or will be deducted from their existing account for those who have a pre-paid number. The transaction is hassle-free, quick, secure and convenient for recurring purchases.

Emerging markets like MENA present a huge potential for DOB.T-PayTM is working together with merchandisers and operators in this region to lead this growth and help mobile developers reach a wide range of consumers.

What are the types of business partners and merchants that can use the T-Pay platform and what are the available payment options?

T-PayTM is a perfect partner for online businesses that offer digital products and services, especially those who look for small repeated purchases. We have partnered with a large network of merchants in diversified sectors, like gaming, classifieds, entertainment VOD and OTT platforms, social learning and education, pre-paid cards stores, as well as professional consulting services.

T-PayTM offers two payment options; the first one is a one-time payment, which allows merchants to charge users for one-off purchases with a single transaction; the second is the recurring payment option. This is mainly used for subscription services that allows merchants to charge subscribed users for a service or product on a periodic basis whether daily, weekly or monthly.

What is T-Pay’s competitive edge?

T-PayTM provides its partners with a simple, turn-key solution for their businesses; whether merchants or operators. T-PayTM offers online digital businesses a comprehensive, state-of-the-art direct billing suite. The team’s support encompasses carrier management and service approvals, payment process localization, cross borders transaction processing and reporting, compliance with operator rules and technical requirements, knowledge of local regulations and taxes, high price range availability, alternative payment flows and billing technologies, conversion optimization and customer care service.

It’s good to see innovative ideas like T-Pay going live, to help businesses convert their online users into buyers.

News

Saudi Fintech Lendo Signs MOU with J.P. Morgan

Lendo, a Saudi Arabia-based Shariah-compliant crowdlending marketplace, has signed a Memorandum of Understanding (MOU) today with J.P. Morgan to improve access to financing for small and medium-sized enterprises (SMEs) across the country.

The MOU was signed during 24 Fintech, a premier fintech event that brings together industry leaders, innovators, and investors in Riyadh.

J.P. Morgan and Lendo are working together on potential opportunities to support the SME sector in Saudi Arabia in growing and sustaining the remarkable demand in this market.

“This strategic collaboration with J.P. Morgan, a pioneer in the financial industry, marks a significant milestone for Lendo,” said Osama Alraee, CEO and co-founder of Lendo. “By combining our strengths, we’ll deliver cutting-edge financial solutions to SMEs, supporting their growth and contributing directly to the realization of Saudi Arabia’s Vision 2030.”

The SME financing landscape in MENA presents a substantial market opportunity as limited financial access continues to restrict the growth of the region’s businesses, with commercial banks hesitant to issue loans to SMEs at scale, resulting in a high percentage of declined financing requests annually.

The total SME financing gap in developing countries is estimated to be approximately $5.2 trillion, according to the International Finance Corporation (IFC).

Lendo’s debt crowdfunding platform aims to bridge the financing gap for SMEs, aligning with Saudi Vision 2030’s goal to significantly expand SME lending from 4% in 2018 to 20% by 2030.

According to the latest available report from the Saudi Central Bank (SAMA), the total value of debt crowdfunding in Saudi Arabia surged from SAR 1.4 million in 2019 to SAR 771 million in 2022, marking a remarkable growth.

Lendo raised SAR 132 million ($35.2 million) in total funding from leading investors, including the most recent Series B led by Sanabil Investments, a wholly-owned company by the Public Investment Fund (PIF).

Since its inception in December 2019, Saudi fintech Lendo has processed over 5,000 financing transactions on its platform, providing over SAR 2 billion ($600 million) in financing to SMEs and generating SAR 280 million ($74 million) in returns for investors.

News

TA Telecom Introduces AnteThink: A New AI Decision Support Tool

TA Telecom, a prominent player in the Middle East’s tech sector, has unveiled AnteThink, an AI-driven tool designed to enhance decision-making processes for individuals and businesses alike.

With a history of influencing the tech landscape through various initiatives, including advanced mobile solutions, high-volume payment platforms, and ventures in e-commerce, fintech, and analytics, TA Telecom has carved a niche for itself. Serving a vast user base of 40 million and processing an impressive 15 billion transactions across its platforms, TA Telecom has cemented its position as a tech industry leader, with some of its ventures achieving the status of Y Combinator companies.

Established in 2000, TA Telecom has emerged as a prominent player in the technology sector. With over 40 million users and processing 15 billion transactions annually, TA Telecom has made a notable impact. Recognized for its contributions by the Financial Times and featured on Deloitte’s list of fastest-growing tech companies in EMEA, TA Telecom is known for its adaptability and forward-thinking approach in the ever-evolving global tech landscape.

Sameh Ibrahim, CEO of TA Telecom, highlights the potential of AnteThink: “AnteThink reflects our commitment to leverage technology for practical impact. It aims to provide clarity and confidence in decision-making, whether in the professional or personal sphere. AnteThink is a tool that can empower startup founders, executives, and individuals to make more informed choices, alleviating the stress and uncertainty often associated with critical decision-making.”

Mostafa Ashour, CEO of Y Combinator-backed startup NowPay, shared his perspective on AnteThink: “AnteThink transformed our strategic planning, allowing us to explore various scenarios and prepare for different outcomes. It has strengthened our decision-making process, helping us navigate the complexities of the business landscape.”

AnteThink embodies TA Telecom’s commitment to innovation, focusing on supporting the startup ecosystem. The tool is tailored to help leaders and executives navigate the complexities of business management and strategic development by providing a clear picture of potential outcomes.

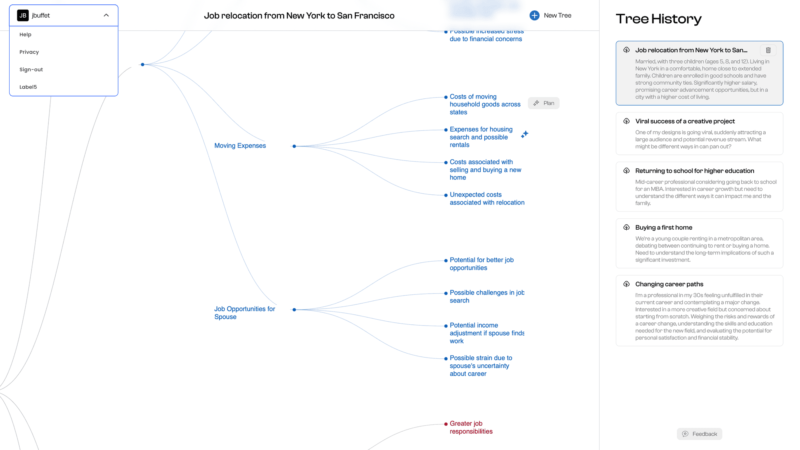

Key Features of AnteThink include:

1. Second Order Mode: Offering a comprehensive analysis of broader impacts, fostering a strategic mindset for long-term success.

2. Optionality Mode: Enabling detailed evaluation and comparison of different choices to ensure decisions align with strategic objectives and values.

3. Inversion Mode: Focusing on identifying and mitigating potential risks, thereby strengthening risk management strategies.

Credit: Antethink

AnteThink’s advanced AI technology aims to assist decision-makers with insightful analytics, offering guidance through the decision-making process.

News

GoDaddy’s Global Markets VP Predicts Egypt’s E-commerce to Hit $9.88 Billion by 2028

Selina Bieber, the Senior Director of Global Markets at GoDaddy, has predicted a significant increase in Egypt’s e-commerce revenue. By 2028, it could reach $9.88 billion.

Godaddy is forming strategic partnerships and launching initiatives to help local entrepreneurs. These efforts align with Egypt’s digital transformation goals and its Vision 2030.

In an interview with the Arabic financial news “Amwal Al Ghad,” Bieber spoke about GoDaddy’s plans and how they match Egypt’s 2023 strategy. She highlighted the company’s aim to provide effective, easy-to-use digital tools and services. By 2024, GoDaddy wants to serve more customers in Egypt by making its digital tools more widespread.

The company is working closely with the Egyptian government, especially the Ministry of Planning. They are offering training programs to improve the digital skills of startups and existing businesses. GoDaddy’s services in Egypt include domain registration, web hosting, e-commerce solutions, and digital marketing tools.

Recent surveys support Bieber’s positive outlook for e-commerce in Egypt. They show a clear trend towards digital strategies among small businesses. Many are realizing the importance of having an online presence for their growth and success.

As GoDaddy continues its partnerships and supports government digital initiatives, its influence on Egypt’s digital landscape is growing. The company is committed to sustainability and reducing its carbon footprint. It aims not just for business growth but also to contribute to a sustainable and thriving digital economy in Egypt.

The 2028 projection indicates a vast potential for e-commerce, with GoDaddy playing a key role in this digital evolution.

-

Startups9 years ago

Startups9 years ago3 Creative Egyptian Women Who Master E-commerce

-

News9 years ago

News9 years ago11 Talented Egyptian Photographers on Instagram

-

Campaigns8 years ago

Campaigns8 years agoVodafone Egypt Brings Generations Together, Unlocks 4G Power

-

Marketing8 years ago

Marketing8 years agoWhich categories will suffer most from increased prices in Egypt?

-

Apps8 years ago

Apps8 years agoRadio Garden Live Map of The Globe’s Radio Stations

-

News8 years ago

News8 years agoTop 10 Egyptian Fashionistas to Follow on Instagram

-

Campaigns8 years ago

Campaigns8 years ago7 Big Stats That Show Which Ramadan Advertisements Resonated Most

-

Opinion8 years ago

Opinion8 years agoF*** Being a Founder, Be a Follower